Minimum Attractive Rate of Return Definition

Find the rate of return on the difference column. The required rate of return RRR is the minimum amount of return that is expected to be received on an investment.

Internal Rate Of Return Formula Definition Investinganswers

The riskier the venture the higher the expected rate of return.

. A minimum acceptable rate of return MARR is the minimum profit an investor expects to make from an investment taking into account the risks of the investment and the opportunity cost of undertaking it instead of other investments. For example an investor who can earn an annual return of 11 on certificates of deposit may set a required rate of return of 15 on a more risky stock investment before considering a shift of funds into stock. Target ROR or Required ROR.

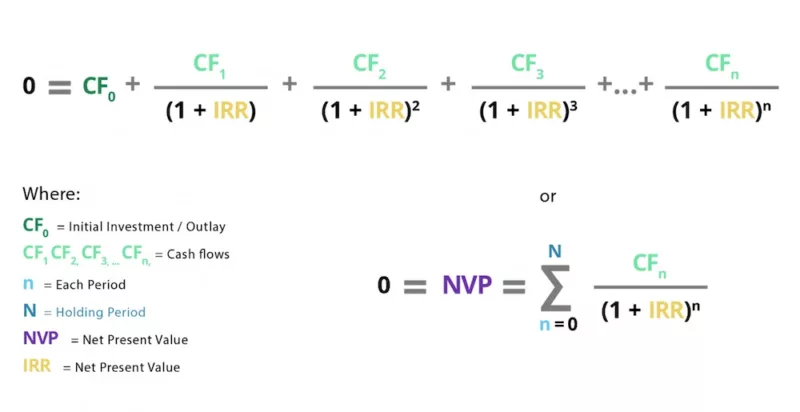

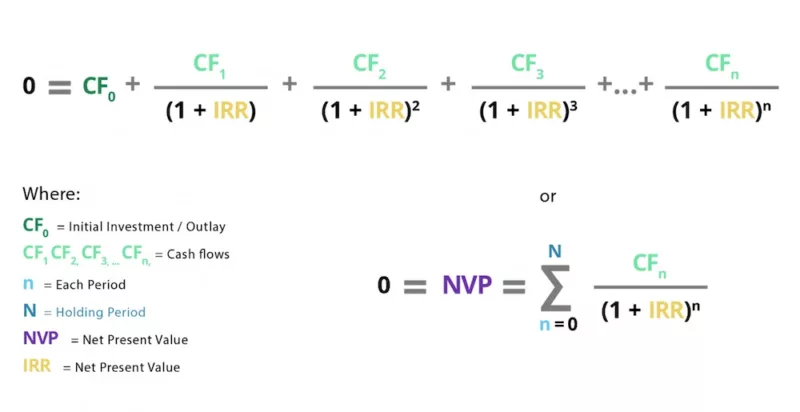

A discussion of methods of determining a minimum attractive rate of return for public investments. 0 -30000 9000 PA i 4 PA i 4 33333 i is between 7 and 8 Since i 12 eliminate 2. The internal rate of return IRR is the annual rate of growth that an investment is expected to generate.

Once a rate of return for an investment is known it can be compared with the minimum attractive rate of return. A project is not economically viable unless it is expected to return at least the MARR. So as a rule of thumb you need to remember the following very very very carefully.

Year 0 -1000-500- 1200. View the full answer. Professor Ibrahim Odeh discusses the Mathematics of Money beginning with a definition of the Time Value of Money.

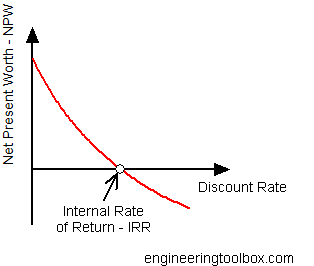

We review their content and use your feedback to keep the quality high. IRR is calculated using the same concept as net present value NPV except it sets the. Up to 5 cash back An organizations minimum attractive rate of return MARR is just that the lowest internal rate of return the organization would consider to be a good investment.

In order to clarify the fundamental logic of interest the first part of this paper considers a riskless world in which there would be no uncertainty and hence no distinction between equity. The rate of return available to investor should they choose to invest funds elsewhere rather than in the current proposal. Illustrated in this module is drawing a cash flow diagram.

The MARR is usually equal to the current rate of interest for borrowed capital plus an additional rate for such factors as risk uncertainty and contingencies. MARR You must still have a return of more than that 10 at least 11 to make business otherwise you will lose in the future so the MARR is the minimum to safeguard. There is one fundamental relationship you should be aware of when thinking about rates of return.

0 -60000 25000 PA i 4 PA i 4 24000. The first expression is the MARR which is the Minimum-Attractive Rate of Return If you have the interest to borrow from your cousin to start a new business to open a coffee business. A hurdle rate which is also known as the minimum acceptable rate of return MARR is the minimum required rate of return or target rate that investors are expecting to receive on an investment.

The minimum rate of return that an investment must provide or must be expected to provide in order to justify its acquisition. MARR i i irisk 4. A Rigorous Mathematical Approach to the Economic Rate of Return ERR and.

Another way of looking at the MARR is that it represents the organizations opportunity cost for. Rate set by an organization to designate lowest level of i that makes a cash flow option acceptable. The rate is determined by assessing the cost of capital.

If the investors paid less than 463846 for all same additional cash flows then their IRR would be higher than 10. A discussion of methods of determining a minimum attractive rate. MARR Minimum attractive rate of return.

MARR is also referred to as the hurdle rate cutoff rate benchmark rate and minimum acceptable rate of return. That will then tell us that the MARR the Minimum Attractive Rate of Return in your case would be 50. In business and engineering the minimum acceptable rate of return often abbreviated MARR or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project given its risk and the opportunity cost of forgoing other projects.

Conversely if they paid more than 463846 then their IRR would be lower than 10. The Minimum Attractive Rate of Return MARR is a reasonable rate of return established for the evaluation and selection of alternatives. For example suppose a.

In its simplest form John Does rate of return in one year is simply the profits as a percentage of the investment or 3000500 600. The tabulation of cash flow is left to the student The rate of return equation is. Rate of return Current value Initial value Initial value 1 0 0 textRate of return fractextCurrent value - textInitial valuetextInitial valuetimes 100.

4 against next alternative ie. If the interests on your investment is less than your MARR then the investment to you is not profitable to your company its not profitable. This means the net present value of all these cash flows including the negative outflow is zero and that only the 10 rate of return is earned.

Annual worth of alternative w -1000 AP 14 4 350 -1000 03432 350 -3432 350 68. A synonym seen in many contexts is minimum attractive rate of return. Learn about the formula and calculation of.

7-75 lf the minimum attractive rate of return is 14 which alternative should be selected. IRR Internal rate of return i Interest rate at which the PW of cash flow equals 0. The MARR is a statement that an organization is confident it can achieve at least that rate of return.

The present worth is discounted at a predetermined rate of interest called the minimum attractive rate of return MARR or i. 1600 20 Web Discount. This criterion is known as the minimum attrac tive rate of return or MARR.

Calculating simple and compound interest rates are covered along with distinguishing between nominal and effective interest rates. Minimum Attractive Rate of Return for Public Investment Author. If the rate of return is equal to or exceeds the minimum attractive rate of return the investment is qualified ie the alternative is viable.

What Is Minimum Acceptable Rate Of Return Capital Com

Minimum Attractive Rate Of Return Marr Return On Software Maximizing The Return On Your Software Investment Book

No comments for "Minimum Attractive Rate of Return Definition"

Post a Comment